About the Author

Luca De Giglio is a veteran in travel tech and a Web3 trailblazer. As founder of Trips Community and co-founder of Tectris, he has led pioneering work in stablecoin payments, NFT bookings, and decentralized travel infrastructure.

Executive Summary: Stablecoins in Travel - The 2025 Implementation Guide

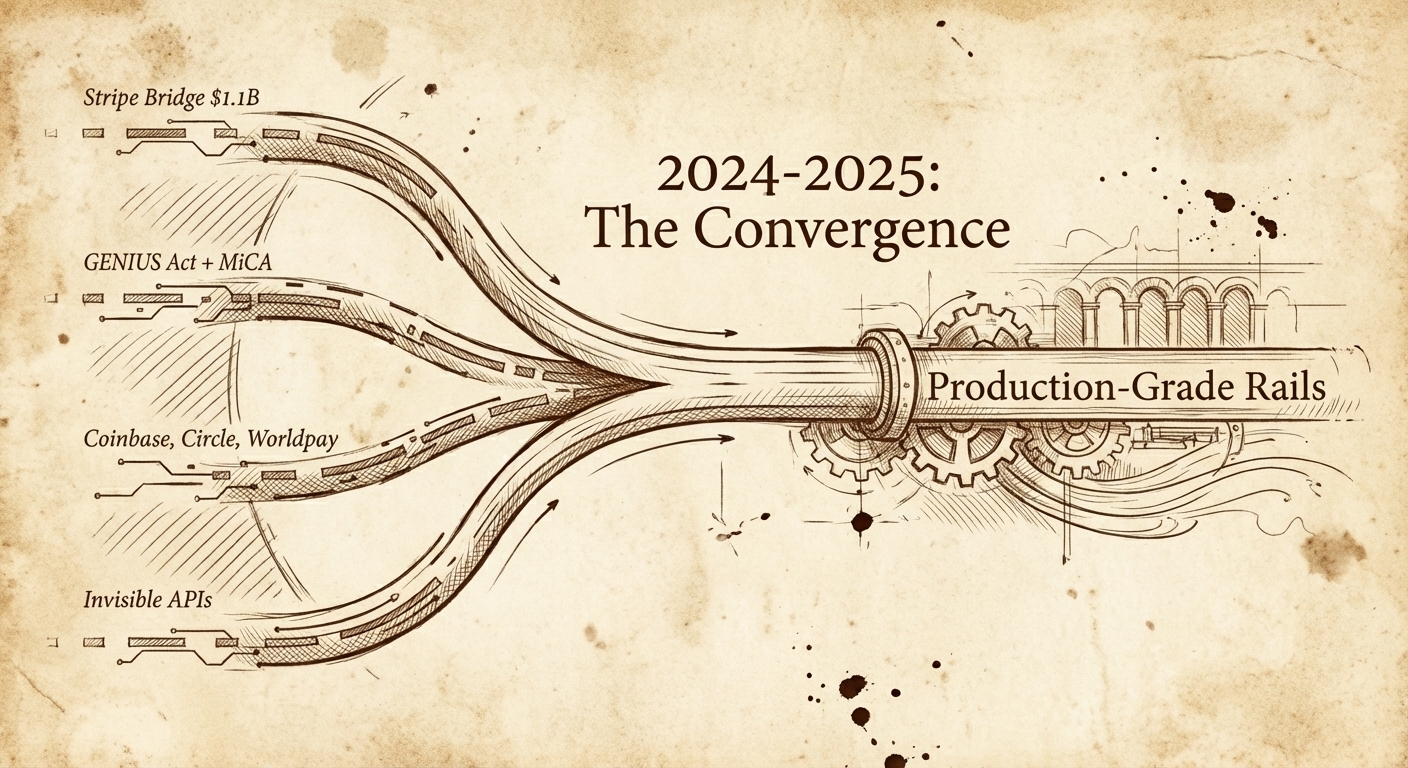

For nearly a decade, stablecoin payments remained a solution in search of a problem travel companies were willing to solve. The technology worked, but implementation required specialized engineering, operated in regulatory uncertainty, and demanded more organizational change than most executives could justify. That changed between 2024 and 2025.

Stripe spent $1.1 billion acquiring Bridge—its largest acquisition ever and the largest crypto acquisition in history. The US passed the GENIUS Act, creating a federal stablecoin framework. The EU implemented MiCA, bringing regulatory clarity across 27 member states. Coinbase, Circle, and Worldpay-BVNK launched production-grade payment infrastructure specifically targeting B2B use cases. The result: stablecoin settlement is now available through the same licensed processors travel companies already use, with APIs that look nearly identical to credit card integration.

The economics are straightforward. Cross-border payment costs through traditional banking run 2–7% when accounting for wire fees, correspondent bank charges, and FX spreads. Stablecoin rails reduce this to 0.5–1%. Settlement that takes 3–5 business days now completes in minutes, 24 hours a day, 365 days a year. For a company moving $50 million internationally each year, this represents over $1 million in direct savings—before considering the working capital freed by faster settlement or the 4%+ yield now available on stablecoin treasury balances.

Travel is particularly well-positioned to benefit because its payment flows are disproportionately international and multi-party. OTAs pay hotels in dozens of currencies. Vacation rental platforms pay hosts across 100+ countries. Tour operators settle with suppliers who operate outside mainstream banking infrastructure. Commission payments flow through consortia, GDS systems, and agency networks with reconciliation complexity that leaks an estimated 25% of earned revenue. Each of these pain points maps directly to a stablecoin capability: lower costs, faster settlement, transparent records, programmable splits.

Yet adoption remains early. Travala processes $103 million in crypto bookings annually. airBaltic has accepted cryptocurrency for 11 years. Emirates announced a 2026 launch with Crypto.com. But major OTAs, hotel chains, and PMS companies have not deployed at scale. The gap between infrastructure readiness and organizational adoption creates a window—likely 12–24 months—where companies that move early can capture cost advantages before stablecoin rails become industry standard.

The practical approach is narrow and incremental. Start with B2B supplier payments in one or two high-friction corridors. Use a licensed processor like Stripe Bridge or Circle. Run a 60–90 day pilot with 5–50 willing partners. Measure cost savings, settlement speed, and operational friction against existing rails. Scale only where benefits prove out. Keep traditional payment methods as fallback throughout. This is not a transformation project—it's a controlled test of better infrastructure.

The risks of moving early are modest: a few weeks of integration time, some internal coordination, and the attention required to monitor a pilot. The risks of waiting are structural: competitors who implement stablecoin rails will operate with permanently lower payment costs. They will offer suppliers better terms, pay hosts faster, and optimize treasury in ways that compound year over year.

This guide provides the detail behind that choice. It covers what changed in 2024–2025, maps payment pain points to stablecoin solutions, compares infrastructure providers, explains regulatory requirements by region, and offers month-by-month implementation roadmaps for specific use cases. The material is written for CFOs, treasurers, and payment executives who need business cases and implementation paths—not technology education.

The infrastructure is ready. The regulations are clear. The economics are proven. What remains is the decision to act.

The Enterprise Index

This guide moves beyond theoretical startups. The infrastructure and adoption drivers referenced herein are powered by regulated, publicly traded entities and major capital market players.

Payment & Financial Infrastructure

- Visa (NYSE: V)

- Coinbase (NASDAQ: COIN)

- Circle (NYSE: CRCL)

- Fidelity National (Worldpay) (NYSE: FIS)

- WEX Inc. (NYSE: WEX)

- Emirates NBD (DFM: ENBD)

Travel & Distribution Leaders

- Lufthansa Group (XETRA: LHA)

- International Airlines Group (LSE: IAG)

- TUI Group (XETRA: TUI1)

- Amadeus IT Group (BME: AMA)

- Expedia Group (NASDAQ: EXPE)

- Booking Holdings (NASDAQ: BKNG)

Note: Key infrastructure is also provided by major private entities including Stripe (91B valuation) and Revolut (75B valuation), alongside specialized travel networks like Chain4Travel.

Introduction

On October 21, 2024, Stripe announced its largest acquisition ever: Bridge, a stablecoin payment infrastructure company, for $1.1 billion. This wasn't just the biggest deal in Stripe's history—it was the largest crypto acquisition of all time.

Four days later, Patrick Collison, Stripe's CEO, made the company's position clear: "We think it's probable that over the long term, much of the economy will run on stablecoins."

If you're reading this as a travel industry executive, you might be thinking: 'Here we go again. Another crypto pitch. Bitcoin to $1 million, NFT hotel keys, Web3 loyalty points. I've heard it all.'

I understand that skepticism. Having worked at this intersection since 2017, I've watched the hype cycles come and go, to see brilliant ideas fail because they were five years too early, and to learn the hard way that "decentralization" and "trustless" mean nothing to a CFO trying to meet quarterly targets.

But something fundamental changed in 2024 and early 2025. Not in cryptocurrency. In payment infrastructure.

The companies building the pipes of global commerce—Stripe, Coinbase, Worldpay, Circle—made billion-dollar bets that stablecoins are not speculative assets, but better payment rails. The US and EU passed comprehensive stablecoin regulations. Major enterprises started running material payment volume through stablecoin networks. And most importantly: the technology became invisible.

You no longer need to understand blockchain any more than you need to understand SWIFT to send a wire transfer. You don't need to hire crypto engineers any more than you need TCP/IP specialists to run a website. Your suppliers don't need wallets. Your hosts don't need to buy crypto. Your accountants don't need to learn new systems.

What you get instead is simple:

- Dramatically lower cross-border payment costs

- Settlement in minutes instead of 3-5 days

- 24/7/365 availability instead of banking hours

- Transparent, immutable records instead of manual reconciliation

- Treasury accounts earning 4% instead of 0.01%

- Programmability

- Agents

And since we are on the internet here's an even simpler list. With stablecoins:

- Borders are gone

- Money is instant

- Money never sleeps

- Bookkeeping is already done

- Money grows

It's a crude simplification of course, but we need to start from these simple and powerful concepts.

This isn't about cryptocurrency. It's about whether you want to pay banks 5% to move money slowly, or pay Stripe and others 0.8% to move money instantly.

These properties aren't magic—they're the natural result of building value transfer on internet infrastructure. Just as email made sending information free and instant, stablecoin rails make sending value free and instant. The travel industry is discovering what happens when money moves like data.

Why I Wrote This Guide

I've spent the last eight years at the intersection of crypto and travel. I founded the first Web3 in Travel DAO, Trips Community and together we did the first travel token, NFT booking and more. We also held 3 Web3 in Travel Conferences.

I launched the first Web3 in Travel podcast.

I've spoken at conferences about blockchain when audiences were politely skeptical (or openly hostile). I've advised startups trying to build crypto payment solutions that were technically brilliant but operationally impossible.

More recently I have co-founded a Web3 in Travel accelerator, Tectris.vc

I've also been a builder in the vacation rental space since before Airbnb existed. I understand the economic pressures on this industry—the race to the bottom on commissions, the working capital constraints from payment timing, the hidden costs in currency conversion that hosts don't even see.

For years, I've been waiting for crypto technology to be useful in travel, not just interesting. I've watched pilot programs fail, seen promising startups die, and listened to executives explain—correctly—why blockchain payments made no sense for their business.

In 2024, that changed.

Stripe's Bridge acquisition isn't a crypto bet. It's a payment infrastructure bet. When you read Stripe's product announcements, they don't talk about "decentralization" or "trustless systems" or "Web3." They talk about serving 101 countries, reducing payment costs, enabling instant settlement. They talk about the boring, essential work of moving money efficiently.

That's when I knew it was time to write this guide.

Because the travel industry is now exactly 12-18 months away from a structural shift in payment economics. The first companies to implement stablecoin payment rails will capture 2-7% margin advantages over competitors. They'll offer better terms to suppliers and hosts. They'll optimize treasury operations to generate yield on working capital. They'll eliminate reconciliation nightmares that currently leak 25% of travel agent commissions.

And they'll do all of this using infrastructure that already exists, through vendors they already work with, with implementation timelines measured in weeks, not years.

No crypto rabbit hole trip needed.

The companies that wait—that treat this as "emerging technology" or "something to watch"—will find themselves at a permanent cost disadvantage. Not because they're bad at technology, but because they're still paying 3% to banks while competitors pay 0.5% to Stripe.

Who This Guide Is For

This guide is for travel industry executives who:

- Manage international payment flows exceeding $10 million annually

- Experience working capital constraints from slow settlement times

- Pay significant fees for cross-border transactions, currency conversion, or virtual cards

- Deal with reconciliation complexity in multi-party transactions (OTA-hotel-supplier, commission splits, host payouts)

- Operate in or serve emerging markets where traditional banking creates friction

- Want concrete implementation plans, not technology education

This guide is NOT for:

- Crypto enthusiasts looking for investment advice

- Startups trying to build Web3 travel platforms from scratch

- Anyone seeking consumer-facing crypto payment solutions (we focus on B2B here)

- Companies with zero cross-border payment volume

If you're the CFO of a tour operator paying suppliers in 30 countries, the treasurer of a hotel chain managing foreign exchange exposure across regions, or the head of payments at an OTA processing billions in international bookings—this guide is for you.

What You'll Learn

This guide is organized around practical implementation, not theory.

Part I: Understanding the Infrastructure explains what changed in 2024-2025. You'll learn what Stripe Bridge actually does, why payment processors invested billions in stablecoin infrastructure, and how regulatory frameworks (US GENIUS Act, EU MiCA) eliminated legal uncertainty. You'll understand why this is fundamentally different from the "Bitcoin for travel" pitches you've been hearing since 2014.

Part II: Payment Pain Points & Solutions maps every major pain point in travel payments to specific stablecoin capabilities. Cross-border costs, settlement delays, chargebacks, reconciliation complexity, hidden FX fees—we quantify the problem and explain the technical solution. You'll learn why eliminating $25 billion in annual travel industry chargebacks is possible with blockchain irreversibility.

Part III: Use Cases Ready to Deploy provides detailed implementation plans for specific scenarios: B2B supplier payments, host payouts, commission settlements, treasury optimization. Each use case includes economic analysis ($ savings), technical requirements (which providers, which APIs), implementation timeline (usually 2-6 weeks), and counterparty coordination needs.

Part IV: Regulatory & Compliance summarizes what you actually need to know about licenses (merchants need none), tax reporting (complex but solvable), and geographic regulations. You'll learn why accepting stablecoin payments through Stripe or Coinbase creates no additional compliance burden beyond existing money transmitter licenses.

Part V: Implementation Roadmap provides month-by-month playbooks for companies ready to move. Assessment phase (identify high-friction flows), technical integration (API setup, treasury policy), pilot phase (5-10 counterparties), scaling (based on measured results). We include risk mitigation strategies, vendor selection criteria, and accounting considerations.

Part VI: Strategic Positioning addresses the competitive landscape. Who's moving (Emirates, airBaltic, Travala), who's exploring (Airbnb-Worldpay discussions), who's absent (major OTAs, hotel chains, PMS companies). You'll understand the risks of being early versus the risks of being late, and how to position stablecoin capabilities as a competitive advantage.

How to Use This Guide

If you're evaluating whether stablecoins are relevant to your business:

Read Part I (infrastructure overview) and Part II (pain points). It will give you the core economic case. If you manage significant cross-border payment volume and your all-in costs exceed 2%, the answer is yes—keep reading.

If you're ready to build an implementation plan:

Focus on Part III (use cases) and Part V (roadmap). Identify which use case best matches your highest-friction payment flows. Use the provided templates and checklists to assess vendor options and build your business case.

If you need to brief executives or board members:

Part VI (strategic positioning) provides the competitive framing. The key message: "Our competitors will implement this in the next 12-24 months. We can lead, fast-follow, or find ourselves at permanent cost disadvantage."

If you're technical and need to evaluate providers:

The appendices include detailed infrastructure comparisons: Stripe Bridge vs Circle vs Coinbase vs BVNK. We compare API capabilities, blockchain support, pricing, compliance features, and integration complexity.

Three Things to Know Before You Start

1. This is not about speculation

Stablecoins trade at $1.00 ± 0.2% because they're backed 1:1 with dollars in bank accounts or Treasury bills. USDC (the dominant institutional stablecoin) publishes monthly attestations from major accounting firms. You're not taking cryptocurrency price risk. You're using dollars that move on better infrastructure than SWIFT. It's comparable to the landline phone to Whatsapp technological shift.

2. You don't need crypto expertise

Stripe, Coinbase, Circle, and Worldpay-BVNK handle the complexity. Your API integration looks nearly identical to credit card processing. Your suppliers receive bank deposits in their local currency. Your accounting systems see fiat (U$, € etc..) transactions. The stablecoin is invisible infrastructure, like TCP/IP packets you never think about when browsing websites.

3. You can start small

The implementation roadmap in this guide assumes starting with 1-5% of international payment volume. You're not betting the company but running a measured pilot, gathering data, and scaling based on demonstrated ROI. If it doesn't work, you've risked weeks of API integration time, not millions in infrastructure investment.

4. I'm a crypto expert, not a payments expert

In fact, I don't know much about payments, especially at the corporate level. For the purpose of this guide I had to research and I wouldn't be surprised if there are wrong assumptions on specific numbers or outright errors. I wrote this guide mostly to research and reason through this systematically. You should read this guide mostly to learn the blockchain party, not to learn how legacy payments work. Your situation, costs and constraints will certainly be specific, keep those in mind, compare them to the stablecoins solutions and this guide may be valuable to you.

Let's Begin

If you've made it this far, you're already ahead of most travel executives who dismissed this as "crypto" and stopped reading.

The infrastructure is ready. The regulations are clear. The economic case is proven. The only question is whether you'll be among the first to capture the advantage, or among the many who wish they had moved sooner.

Let's start with what actually changed in 2025.

Luca De Giglio has worked at the intersection of blockchain technology and travel since 2017. He has spoken at major vacation rental conferences (VRWS, ITB and many others), hosts the Web3 in Travel podcast, and advises travel technology companies and startups. He built vacation rental businesses before Airbnb existed and has spent 24 years in the industry. He's been in crypto since 2013. This guide synthesizes years of watching crypto technology mature from interesting to useful, and reflects conversations with dozens of travel executives exploring stablecoin adoption.

Chapter 1: THE 2024–2025 SHIFT — WHY THIS TIME IS DIFFERENT

Stablecoins have existed for nearly a decade, but 2024–2025 was the first time they became infrastructure. The world’s major payment processors — Stripe, Coinbase, Circle, Worldpay — built global stablecoin rails in parallel, and regulators in the US, EU, and Asia delivered clear legal frameworks. For the first time, stablecoin payments no longer require crypto expertise, custom engineering, or regulatory guesswork.

This chapter explains what changed, who changed it, and why these changes matter specifically for the travel industry. Once you see the shift at the infrastructure level, the rest of the guide becomes a practical discussion about new payment rails, not a crypto story.

1.1 What Actually Changed

Between mid-2024 and early 2025, four parallel developments landed at the same time:

-

Payment processors deployed stablecoin rails at scale.

Stripe acquired Bridge for $1.1B — the largest acquisition in its history. -

Regulation moved from grey to defined.

The US GENIUS Act, EU MiCA, Singapore, and Hong Kong all delivered clarity. -

Enterprises began using stablecoins for real B2B volume.

Starlink in Argentina, Remote.com, and others proved the economics. -

The technology became invisible.

You no longer “integrate blockchain” — you integrate Stripe, Coinbase, or Circle.

This is the inflection point:

Stablecoins stopped being an asset class and became a payment rail.

1.2 The Stripe Signal

Stripe does not make ideology-driven bets.

Stripe does not “experiment” with billion-dollar acquisitions.

Bridge’s $1.1B price tag communicates a simple fact:

Stablecoin rails are strategically important to Stripe’s future.

Stripe’s logic is straightforward:

- Cross-border payments are expensive

- Settlement is slow

- FX is opaque

- Emerging markets are painful

- Banking hours are restrictive

Stablecoins solve all of these — without asking users to touch crypto.

1.3 Infrastructure Buildout Across the Industry

All major money-movement companies made similar moves:

- Coinbase launched Coinbase Payments and Coinbase Business

- Circle expanded USDC/EURC payment APIs

- Worldpay + BVNK built travel-specific stablecoin payout infrastructure

- Checkout.com quietly processed USDC settlement since 2022

All in under 18 months.

This alignment is the key:

When four independent players build the same thing at the same time, it’s not a trend — it’s infrastructure.

1.4 Regulatory Clarity Arrived

2024–25 brought something the crypto industry had never seen:

Actual laws, not proposals.

- GENIUS Act (US) — clear rules, 100% reserve stablecoins, merchants need no license

- MiCA (EU) — EURC/EURe fully compliant, issuers regulated, merchants exempt

- Singapore / Hong Kong / Japan — comprehensive stablecoin frameworks

You don’t have to like these laws.

But you can plan around them — which was impossible before 2024.

1.5 Invisible Technology

The most important shift is the least dramatic:

You no longer need blockchain engineers.

You need:

stripe.bridge.payments.create()

That’s it. The processor:

- Handles the wallet

- Executes the blockchain transfer

- Converts to fiat

- Reconciles the transaction

- Logs everything for accounting

- Manages compliance

- Keeps the supplier oblivious to the technology underneath

Blockchain is now TCP/IP: essential but unseen.

1.6 The Resulting Economic Shift

All this infrastructure change has one outcome:

The cost structure of moving money internationally collapses.

You move from:

- 2–7% → 0.5–1%

- 3–5 days → minutes

- Opaque FX → transparent

- Business-hour settlement → 24/7/365

- Manual reconciliation → automatic provable ledger

This chapter simply establishes why this guide exists:

The technology finally crossed the threshold into practicality.

Conclusion

Stablecoins did not become useful because crypto evolved — they became useful because payment infrastructure evolved. The rails are now global, regulated, invisible, and already moving billions in B2B volume.

The question moving forward is simple:

If the underlying rails just changed, what travel payment problems do these rails finally solve?

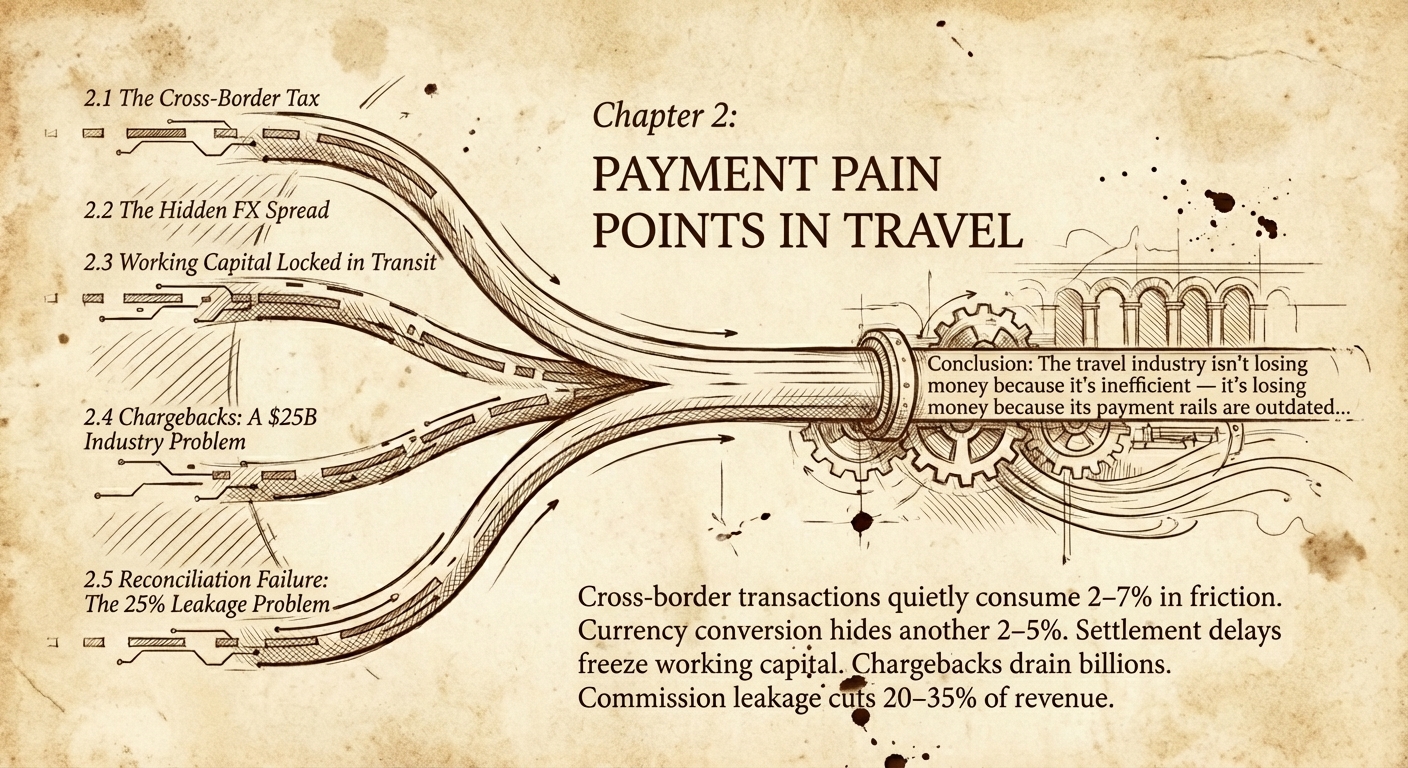

Chapter 2: PAYMENT PAIN POINTS IN TRAVEL

Every travel company already knows payments are expensive and slow, but most underestimate the scale and structure of the problem. Cross-border transactions quietly consume 2–7% in friction. Currency conversion hides another 2–5%. Settlement delays freeze working capital for days or weeks. Chargebacks drain billions annually. Commission leakage cuts 20–35% of revenue before anyone notices.

This chapter quantifies these pain points clearly and shows where the industry loses the most money. Before you consider new payment rails, you need a precise view of what the current rails cost you — and why those costs keep rising.

2.1 The Cross-Border Tax

International payments silently take 2–7% of value through:

- FX spreads

- Intermediary bank fees

- Incoming wire fees

- Outgoing wire fees

- Long settlement windows (float cost)

A $10,000 supplier payment often costs $250–400 in hidden friction.

Multiply by $50M annual payments → $1.25–2M/year lost.

Stablecoins reduce this to 0.5–1% through:

- Transparent pricing (Spot rate + ~0.5% conversion fee)

- Removal of correspondent banking intermediaries

- Faster settlement (minutes)

- 24/7 availability

2.2 The Hidden FX Spread

The most underestimated cost in travel.

Platforms and banks embed 2–5% of spread into published rates.

Examples:

- Host receives €1,100 instead of €1,143

- OTA collects hidden spread on both ends

- Card networks + banks each apply their own FX layers

Stablecoins surface FX explicitly:

- Market rate

- +0.5% processor fee

- Final amount visible on-chain

Transparency alone is revolutionary.

2.3 Working Capital Locked in Transit

Money stuck in motion is money you cannot use.

- Wires: 3–5 days

- Cross-border ACH: 2–6 days

- OTA → hotel payouts: 15–30 days

- Agent commissions: 30–90 days

A tour operator sending $100M abroad has $1M+ locked in banking limbo.

Stablecoins settle in minutes, not days.

Working capital becomes available immediately.

2.4 Chargebacks: A $25B Industry Problem

Hotels and travel merchants lose more to chargebacks than fraud.

- Up to 20% annual revenue loss in hotels

- 40% friendly fraud

- 2.4–3.5× transaction cost per dispute

- 60% of consumers file without contacting merchant

- Airlines lose $1B/year

Stablecoins are irreversible — ideal for B2B settlement. Refunds become voluntary business decisions, not forced reversals.

2.5 Reconciliation Failure: The 25% Leakage Problem

Commission flows in travel are chaotic:

OTA → hotel → consortium → agent.

And the result:

- 25% of agent commissions never paid

- Missing invoices

- Misaligned booking IDs

- Multi-currency mismatches

- Virtual card reconciliation issues

Stablecoins provide:

- A single source of truth

- Immutable timestamps

- End-to-end payment traceability

You don't eliminate reconciliation — you eliminate most causes of friction.

Conclusion

The travel industry isn't losing money because it's inefficient — it's losing money because its payment rails are outdated. High friction isn't a bug in the system; it is the system.

Now that the pain is clear, Chapter 3 maps each pain point to the specific mechanisms stablecoin rails use to eliminate or reduce it. It's not magic — it's mechanics.

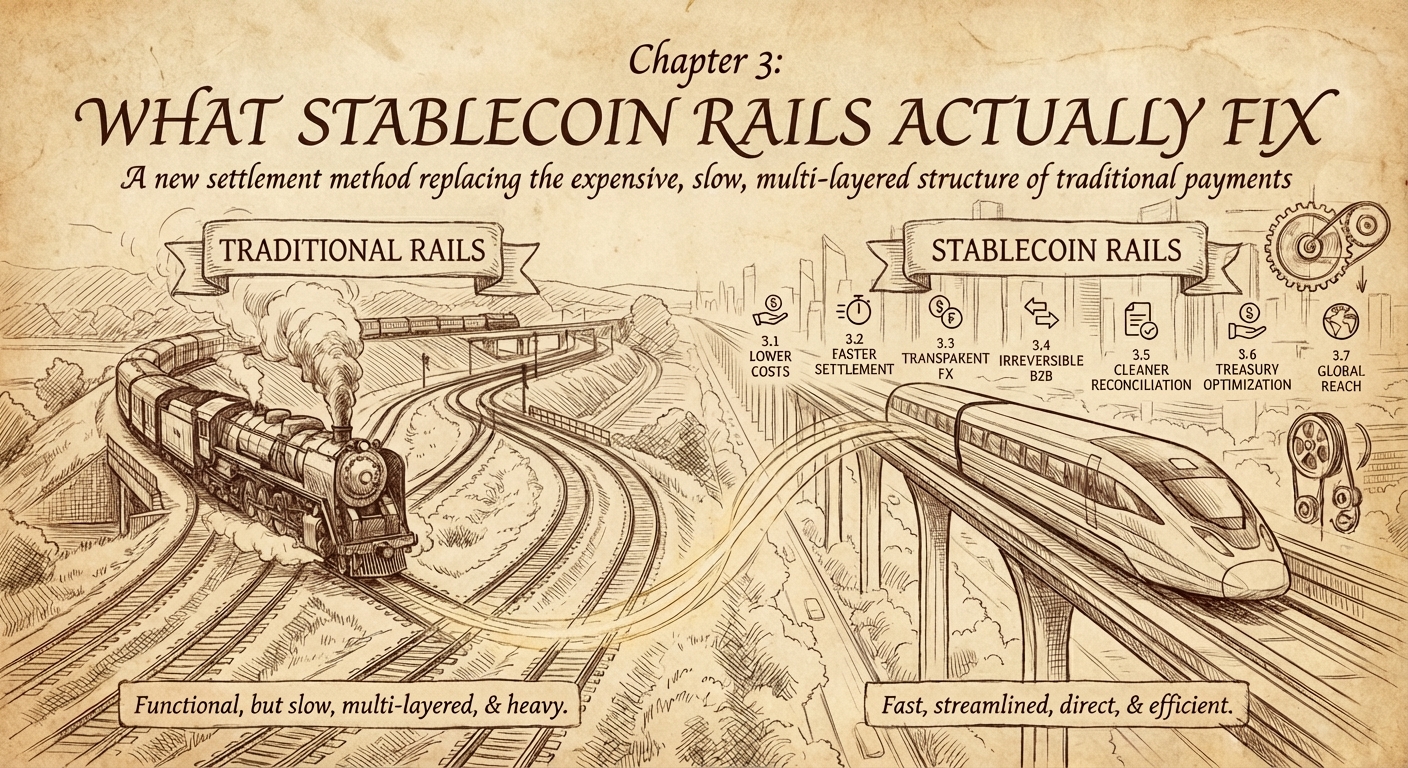

Chapter 3: WHAT STABLECOIN RAILS ACTUALLY FIX

Stablecoins are not a new currency — they are a new settlement method. Their value lies in how they replace the expensive, slow, multi-layered structure of traditional international payments. This chapter links each major travel-industry pain point to the specific feature of stablecoin rails that solves it: lower costs, faster settlement, transparent FX, irreversible B2B payments, cleaner reconciliation, global reach, and better treasury returns.

Think of this chapter as the technical translation layer — not "how stablecoins work," but "how stablecoin rails change the economics of moving money."

3.1 Cost Structure Compression

Traditional payment rails impose a hidden cross-border tax of 2–7%, combining FX spreads, correspondent banking fees, and settlement friction.

Stablecoin rails reduce this to 0.5–1% end-to-end.

They do it by removing structural layers:

- No correspondent banks

- Spot FX with explicit, transparent fees

- Low-cost blockchains (Solana, Base, Polygon)

- Fewer intermediaries in the flow

The result is not a marginal improvement. It is a fundamental rewrite of cost structure.

3.2 Settlement Acceleration

Traditional rails settle on banking hours.

- Cut-off times

- Weekends

- Holidays

- Time-zone delays

Stablecoins settle in 3–45 seconds depending on network.

This eliminates:

- Float losses

- "Payment pending" operational delays

- Supplier frustration

- Cash-flow bottlenecks

When money moves in seconds, entire business processes change with it.

3.3 Transparent FX

Traditional FX hides costs in opaque spreads. Stablecoin FX makes every step visible:

- Stablecoin is minted

- Sent on-chain

- Converted to local currency

- All amounts logged publicly

What you see:

- Amount sent

- Conversion rate

- Fees

- Time of conversion

- Amount received

FX becomes auditable instead of mysterious. Accounting teams gain clarity they have never had.

3.4 Irreversibility for B2B

Stablecoin transfers are final settlement, not reversible messages.

This makes them ideal for B2B:

- Supplier payments

- Host payouts

- Commissions

- Intermediary settlements

- Consolidators

The benefits are operational:

- Lower fraud risk

- Near-elimination of friendly fraud

- No chargeback disputes

- Less administrative overhead

Refunds remain possible — but they become explicit business actions, not forced reversals.

3.5 Unified Ledger for Reconciliation

Every stablecoin payment creates a transparent ledger entry:

- Timestamped

- Immutable

- Visible to both parties

- With attachable metadata (booking ID, commission ID, etc.)

This removes the most common reconciliation failures:

- "We never received the invoice."

- "Our numbers don't match."

- "Your bank shows a different amount."

- "We need to follow up with our bank."

Stablecoin rails don't eliminate reconciliation. They eliminate the causes of reconciliation pain.

3.6 Treasury Optimization

Stablecoins open a new treasury model:

- 4%+ annual yield on working capital (via regulated innovative treasury products)

- Instant liquidity (no lock-up periods)

- 24/7 availability

- Fast conversion back to fiat

This shifts treasury positions from:

→ 0.01% in a checking account to → 4% on liquid stable assets

It is not without risk, but it is materially superior to leaving idle capital in traditional operating accounts.

3.7 Global Reach

Stablecoin payments operate without regard to:

- Banking location

- Capital controls

- SWIFT availability

- USD access

- Local banking infrastructure

They work consistently in:

- Senegal

- Brazil

- Thailand

- Nigeria

- Argentina

- And anywhere else liquidity exists

This unlocks the "long tail" of suppliers — those who are underserved or overcharged by the traditional banking system.

Conclusion

Stablecoin rails do not fix everything, but they fix enough of the right problems to materially shift the economics of travel payments. Costs fall, settlement accelerates, reconciliation becomes cleaner, treasury improves, and global reach expands.

With the mechanics now clear, the next question is practical: Which use cases are ready to deploy today, which require coordination, and which belong in the medium-term roadmap?

That's the focus of the next chapter.

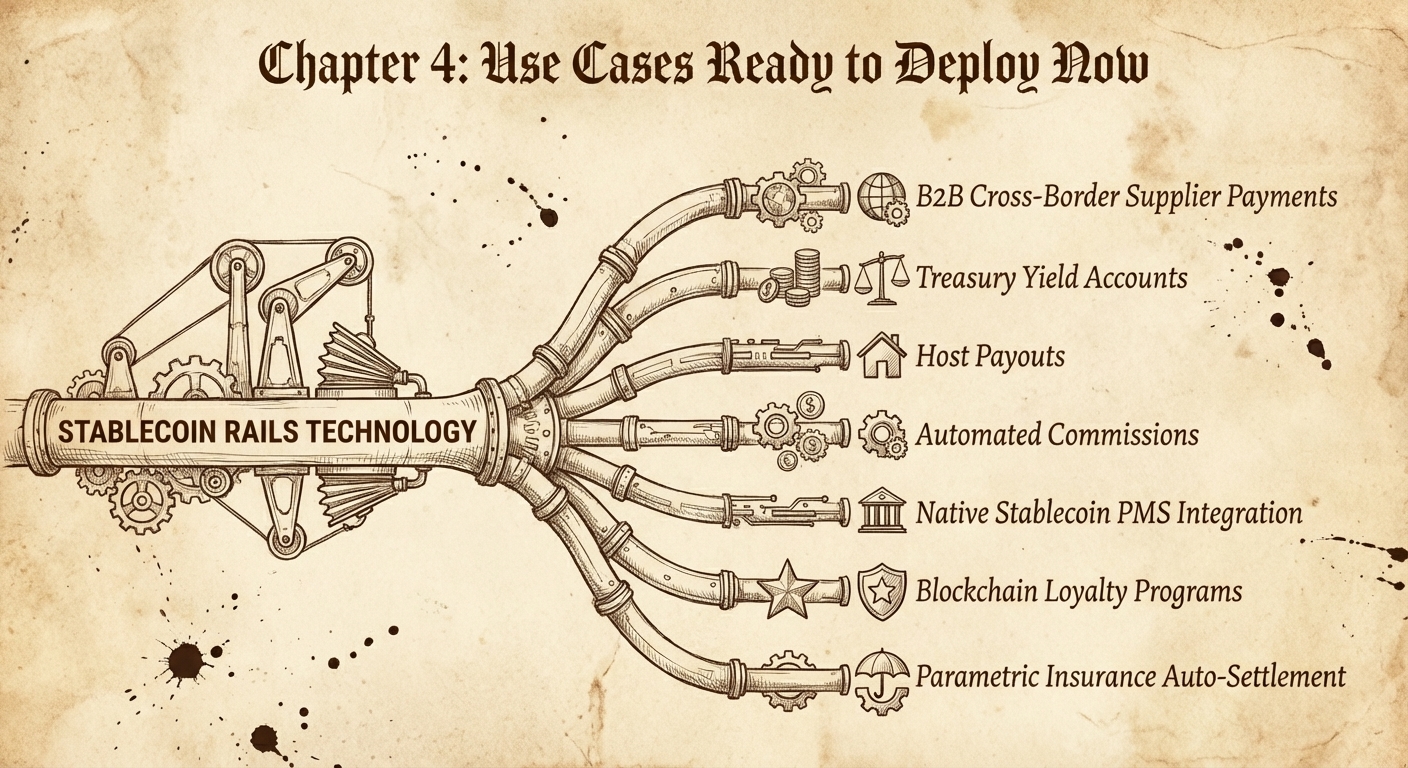

Chapter 4: USE CASES READY TO DEPLOY NOW

Section A — Tier 1 Use Cases (Immediate Deployment)

The use cases in this section are already viable today. The infrastructure is mature, the economics are clear, and the operational workflows fit smoothly into existing systems. These are the scenarios where stablecoin rails deliver value with minimal coordination and without requiring suppliers, hosts, or partners to "adopt crypto."

These are the natural entry points for travel companies beginning to pilot stablecoin payments.

A1. B2B Cross-Border Supplier Payments

Cross-border supplier payouts are the most straightforward and highest-impact use case. Travel companies routinely send large volumes to DMCs, consolidators, hotels, tour operators, and activity providers — often in regions where banking is slow or expensive.

Stablecoin rails reduce the cost of these payments from 2–7% to 0.5–1%, settle in minutes, and remove most FX opacity. The supplier does not need a wallet; processors like Stripe, Coinbase, Circle, and Worldpay-BVNK handle the entire flow end-to-end, converting to local currency on arrival.

The benefits materialize immediately:

- Lower FX spread and fees

- Faster supplier settlement

- Reduced working-capital drag

- More predictable reconciliation

- Fewer payment failures in emerging markets

This is the lowest-risk, highest-certainty starting point. If a travel company adopts only one stablecoin use case in 2025, it will likely be this one.

Field Note: The End of the Virtual Credit Card? The most aggressive version of this use case replaces Virtual Credit Cards (VCCs). PayDocker (by Bakuun Holdings) has successfully deployed this on the Camino Network. By replacing high-fee VCCs with smart-contract-based settlements, they report operational cost reductions of up to 70%. This is not just saving on FX; it is the removal of the 3% interchange fees that traditional intermediaries charge to move money between travel partners.

A2. Treasury Optimization: Stablecoin Yield Accounts

The second Tier 1 use case is not a payment flow but a treasury strategy. Stablecoin accounts from regulated providers (e.g., Coinbase Business, Circle partners) offer 4%+ on liquid balances — far higher than the near-zero yields of traditional corporate accounts.

The appeal is simple:

- Instant access to funds (no lock-up)

- 24/7 liquidity

- Transparent on/off ramps

- Low operational friction

- Adjustable exposure according to risk tolerance

Travel businesses with large operational balances or seasonal cash surpluses gain the most. Even parking a portion of working capital into short-term stablecoin yield accounts can generate meaningful extra income.

This use case requires no supplier adoption, no system changes, and no integration work beyond establishing an account with a licensed provider. It is one of the fastest wins in the entire guide.

A3. Host Payouts for Vacation Rental Platforms

Host payouts are structurally similar to supplier payouts but involve higher frequency and larger distributed networks. For platforms handling thousands of hosts — especially across multiple countries — stablecoin rails offer major operational improvements:

- Lower payout fees

- Faster access to earnings

- Clear FX for hosts

- Reduced bank transfer failures

- 24/7 availability, including weekends

The key driver is economic: Card-based payouts or cross-border bank transfers carry high fees and long delays, particularly in markets where hosts lack efficient banking options.

Stablecoin rails remove this friction, and hosts can still receive fiat via on/off-ramp processors. No host needs a wallet unless they explicitly want one.

This is a Tier 1 use case because the underlying infrastructure is ready today, and the platform can start with a subset of host countries without requiring global coverage.

A4. Commission Payments via Smart Contracts (Tier 1 — High Coordination)

Commission flows between OTAs, hotels, consortia, and travel agents are notoriously inefficient. In theory, smart contracts can automate commission distribution, ensure accurate percentages, attach booking metadata, and create an immutable audit trail.

In practice, this use case requires coordination across multiple parties, which makes adoption slower.

What works today:

- Individual bilateral agreements

- Metadata-rich on-chain payouts

- Automated triggers for release of funds

What is not yet ready:

- Industry-wide standardization

- Multi-party smart contract consortiums

- PMS/OTA integration at scale

This use case sits at the upper boundary of Tier 1: the technology works, but the coordination burden delays deployment. Early adopters will come from:

- Consortia

- Chains with many independent agents

- Niche segments with high leakage problems

The value is strong, but the rollout depends on collective action rather than pure technology.

Section B — Tier 2 Use Cases (12–24 Months)

Tier 2 use cases are technically viable today but depend on ecosystem maturity, partner adoption, or non-trivial product work. These are not experimental ideas — they are realistic pathways that will likely reach production within one to two years, once the industry aligns around standards and integration points.

B1. PMS Companies Offering Native Stablecoin Integration

Property management systems (PMS) sit at the operational core of short-term rentals and independent hotels. They already handle:

- Calendar sync

- Pricing

- Channel management

- Invoicing

- Payouts

- Commission calculation

This makes them a natural candidate for stablecoin rails — especially for payouts to owners, revenue-share arrangements, and intermediation between platforms.

Why this is Tier 2

The value is clear, but adoption requires:

- PMS-side product development

- Structured integrations with on/off-ramp providers

- Updated reporting and reconciliation workflows

- Clear legal and tax handling per market

PMS companies must also coordinate with hosts, OTAs, and banks — which introduces friction no single actor controls.

Despite this, the opportunity is strong. PMS involvement could unlock mass adoption faster than any OTA-led initiative, because PMS platforms already own the operational layer where payments are triggered.

This use case is expected to mature as providers like Worldpay-BVNK release PMS-friendly APIs and stablecoin payout modules.

B2. OTA Loyalty Programs on Stablecoin Rails

Loyalty points often behave like a closed-loop currency, which makes them structurally well suited to blockchain rails. Stablecoins or tokenized loyalty credits can bring:

- Instant issuance

- On-chain transferability

- Lower fraud and misuse

- Unified ledgers for earn/burn events

- Real-time redemption settlement

OTAs already maintain large loyalty ecosystems, so the shift would not feel radical to users — only more efficient behind the scenes.

Why this is Tier 2

The blockers are not technical:

- Most programs already run on centralized databases

- Users do not need wallets

- A blockchain layer can be hidden behind the UI

The real bottleneck is organizational appetite. OTAs must prioritize the project, align legal and marketing teams, and build redemption agreements with partners. These hurdles place loyalty automation in the medium-term rather than the immediate-term roadmap.

Still, once an OTA decides to modernize its loyalty infrastructure, stablecoin rails provide a far cleaner and faster ledger than traditional enterprise systems.

Live Example: Sleap.io

We are already seeing the next iteration of this model with platforms like Sleap.io. Operating on the Camino Network, Sleap connects over 1 million hotels to a crypto-native distribution layer. Instead of generic cookies, they use wallet data to offer "Closed User Group" rates to specific communities and deliver booking confirmations as NFTs. This transforms the wallet from a simple payment tool into a digital identity passport that unlocks personalized pricing automatically.

B3. Parametric Insurance Auto-Settlement

Parametric insurance pays out automatically when a predefined condition is met (e.g., flight delay, extreme weather, lost luggage). Stablecoin rails are almost perfectly aligned with this model:

- Smart contracts monitor or receive verified data

- Conditions are triggered automatically

- Settlements are paid instantly

- No claims paperwork

- No adjuster process

- No multi-day banking delays

Travel insurance is full of simple, binary claims — exactly where parametric models thrive.

Why this is Tier 2

Two factors slow adoption:

- Insurance companies must certify blockchain-driven payout systems

- Regulators must approve parametric structures in each jurisdiction

The payout mechanics are ready today. The regulatory and actuarial frameworks are catching up.

Once greenlit, this becomes one of the most powerful travel use cases — not because of blockchain hype, but because it removes the frustration travelers feel with slow, opaque insurance refunds.

Section C — The PMS Strategic Play

Property management systems (PMS) sit in a uniquely powerful position within the short-term rental and independent hotel ecosystem. They orchestrate availability, pricing, reservation flows, invoicing, and payouts. Because of this, PMS companies are structurally better positioned than OTAs or payment startups to introduce stablecoin-based settlement.

This section explains why PMS companies might become the primary adoption engine for stablecoin rails in travel, the economic incentives for each stakeholder, the preferred rollout strategy, and the practical limits that could still slow deployment.

C1. Why PMS Companies Might Be Better Positioned

A PMS controls the operational triggers that matter:

- When a booking is confirmed

- When an invoice is generated

- When a payout is released

- When commission splits occur

- When owner statements are finalized

OTAs sit at the top of the funnel, but payout logic lives inside the PMS. This means:

- Stablecoin payouts can be integrated where financial events originate, rather than bolted on later. Hosts and owners already trust their PMS as the system-of-record.

- PMS companies can bundle stablecoin rails into existing payout modules without changing the OTA workflow.

- The PMS provider, not the OTA, can manage local compliance and reporting.

- PMS companies serve the "long tail" of hosts OTAs struggle to onboard efficiently.

In other words: a PMS can adopt stablecoin rails without waiting for the rest of the industry.

This independence is a strategic advantage.

C2. The Economics for Different Stakeholders

For PMS Companies

PMS platforms gain new revenue lines:

- Payment processing margin

- FX margin (explicit, not hidden)

- Value-added treasury distribution

- Premium onboarding for hosts in difficult banking markets

- Reduced support costs around failed or delayed payouts

Stablecoin rails also reduce churn. Hosts who get paid faster are less likely to switch PMS.

For Hosts and Property Owners

Hosts benefit most from:

- Faster access to earnings

- Predictable FX rates

- Fewer failed payouts

- Weekend and holiday settlement

- Clearer reporting

In emerging markets, the difference is transformative: hosts finally receive funds reliably and without punitive bank fees.

For OTAs

OTAs benefit indirectly:

- Improved host satisfaction

- Reduced payout disputes

- Cleaner reconciliation

- Lower customer support volume

But OTAs do not need to adopt stablecoins themselves. The PMS can intermediate the entire flow.

This is the subtle but crucial insight: the PMS is the linchpin for stablecoin payouts even if OTAs remain on legacy rails.

C3. The Implementation Scenario: The Cautious Rollout

The most realistic rollout path is gradual, not industry-wide:

Phase 1 — Limited-Market Pilot

A PMS selects:

- 1–2 countries

- A subset of hosts

- A licensed stablecoin-payments provider (e.g., Worldpay-BVNK, Stripe, Coinbase)

The PMS handles conversion and compliance. Hosts receive payouts in fiat unless they explicitly opt in to stablecoins.

Phase 2 — Geographic Expansion

Add more regions where:

- FX costs are high

- Banks are unreliable

- Payout fragmentation is painful

Examples include Southeast Asia, Latin America, the Balkans, and parts of Africa.

Phase 3 — Automated Commission Splits & Metadata

Introduce:

- Automated revenue-sharing

- On-chain metadata for PMS → owner reconciliation

- Optional stablecoin treasury yield on held balances

At this stage, stablecoin rails feel like better payouts, not a "crypto feature."

Phase 4 — Integration With Insurance & Ancillaries

Over time, PMS platforms can:

- Auto-settle insurance claims

- Handle partner commissions

- Trigger payouts tied to occupancy or performance metrics

This unlocks the true long-term value of programmable money.

C4. Why This Might Work Better Than an OTA-Led Approach

OTAs face structural constraints:

- Global compliance overhead

- Higher risk exposure

- Larger brand and regulatory visibility

- Slower product cycles

- Need to maintain uniform global payout logic

A PMS faces none of these.

A PMS can move faster because:

- It operates in specific markets

- It is not a high-profile global target

- It controls payout logic directly

- It serves hosts who feel the pain most

- It can integrate stablecoins without impacting the guest UX

This is the opposite of most payment innovations, where OTAs typically lead. Stablecoin adoption could follow a bottom-up curve, pushed by PMS platforms solving practical payout problems.

C5. Why This Still Might Not Work

Despite the strengths, PMS-driven adoption faces barriers:

- PMS budgets are often tight

- Teams may lack payment engineering expertise

- Change management inside host communities is slow

- Banks may delay or question outbound transfers from exchanges

- FX and tax reporting must be automated to reduce operational load

- PMS companies are often acquired, slowing innovation cycles

In short: The PMS incentive is strong, but the operational complexity is non-trivial.

Success depends on focusing on a few well-chosen initial markets.

C6. Who Should Try This First?

The most likely early adopters:

- PMS platforms with strong emerging-market penetration

- Platforms serving many independent hosts rather than large chains

- PMS companies with existing payout modules

- PMS businesses seeking differentiation against rivals

- PMS providers already exploring financial products (e.g., payments, POS, insurance)

These companies combine both need and capability.

C7. Alternative: Wait for Worldpay-BVNK

Worldpay-BVNK is building a stablecoin payouts layer specifically for large travel companies. Once fully deployed, PMS companies may prefer:

- Using this infrastructure instead of building their own

- Offering stablecoin-powered payouts with minimal engineering

- Leveraging unified FX and compliance via a single provider

For PMS teams with limited resources, this "wait-and-integrate" model is realistic and attractive.

C8. Bottom Line & Strategic Recommendation

PMS companies are, structurally, the strongest candidates to mainstream stablecoin payouts in the travel industry. They control the operational layer, own the payout logic, and manage the long tail of hosts who face the biggest banking challenges.

However, the most successful strategy is not aggressive rollout — it is a measured, selective, and geographically targeted approach that proves the economics before expansion.

My Recommendation

A PMS should:

- Start with a narrow pilot in two markets where payout friction is extreme.

- Use a licensed stablecoin-payments provider, not self-custody.

- Offer hosts fiat by default, with optional stablecoin opt-in.

- Expand only after proving cost reduction + payout reliability + host satisfaction.

Stablecoin rails are not a marketing feature — they are a quietly transformative infrastructure upgrade. PMS companies are in the best position to make that upgrade real.

Section D — Conclusion: What's Actually Ready in 2025

Stablecoin rails are no longer theoretical. Several use cases deliver value today, some require coordination but are approaching viability, and others sit in the medium-term roadmap. The key is understanding where the industry stands in 2025 — and choosing entry points that align with both feasibility and impact.

What's Ready Now (Tier 1)

The clearest immediate wins are:

- Cross-border supplier payments

- Stablecoin treasury yield accounts

- Host payouts, especially in markets with poor banking infrastructure

These use cases require minimal industry coordination and fit directly into existing workflows. They reduce costs, accelerate settlement, and improve predictability without exposing suppliers or hosts to new complexity.

What Needs Some Alignment (Tier 1C–2)

Commission automation, PMS-native payout flows, blockchain-backed loyalty, and parametric insurance are all technically viable today. What slows them down is not the technology but the need for:

- Shared standards

- Partner coordination

- Regulatory approvals (in the case of insurance)

- Engineering investment across multiple organizations

These are likely to mature over the next 12–24 months, with early adopters proving the value first.

Where Momentum Will Come From

If adoption accelerates, it will come from operational layers, not distribution layers. PMS platforms — not OTAs — are positioned to trigger industry-level change because payouts originate inside their systems, and hosts feel the most acute pain from slow or expensive banking rails.

How Travel Companies Should Act

The right strategy is not aggressive, industry-wide transformation. It is targeted experimentation. Pick the strongest single use case, deploy it where the economics are undeniable, and measure results. Stablecoin rails reward precision, not scale.

Conclusion

Stablecoins do not replace travel's financial infrastructure overnight. Instead, they open pockets of efficiency that grow into broader adoption as more participants benefit. The travel companies that move first will not be the ones chasing hype — they will be the ones solving very practical, very old payment problems with a much cleaner rail underneath.

With the use cases and strategic opportunities mapped, the next question becomes one of execution: How do you implement a stablecoin pilot without disrupting your existing systems or compliance frameworks?

That is the focus of the next chapter.

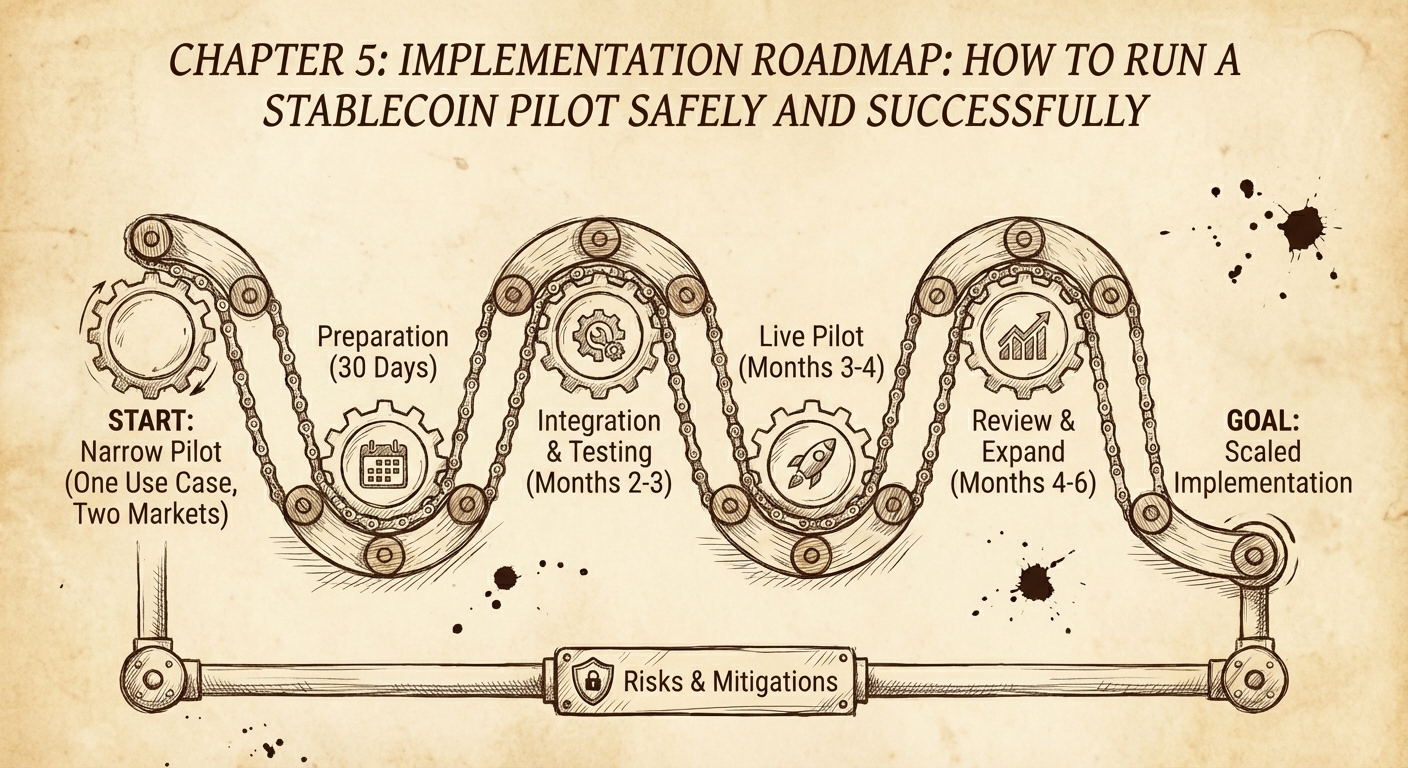

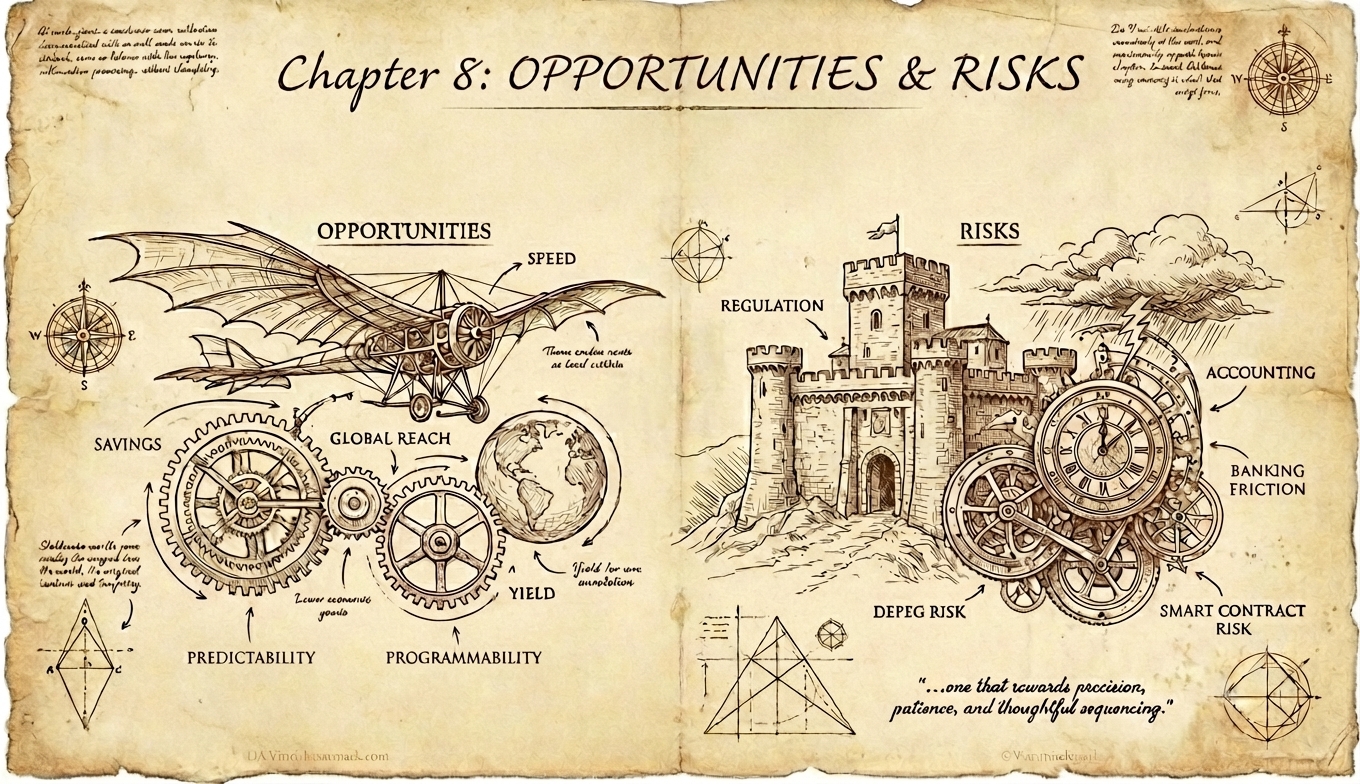

Chapter 5: IMPLEMENTATION ROADMAP

This chapter is written as a practical, no-nonsense guide for travel companies that want to pilot stablecoin payments without introducing operational or regulatory risk. The focus is narrow, controlled experimentation with clear KPIs and a simple path to expansion. You do not need industry-wide adoption, major engineering work, or supplier crypto knowledge. You need preparation, precision, and a small, well-designed test.

5.1 The Principle: Start Narrow, Scale Only on Proof

The most successful projects follow the same formula:

- One use case

- Two markets at most

- A single licensed payments provider

- A clear fallback plan

- A designated internal owner

- Defined KPIs from day one

A stablecoin pilot is not an infrastructure overhaul. It is a controlled experiment to measure:

- Cost reduction

- Settlement speed

- Error reduction

- Cash-flow improvement

- Accounting clarity

- Partner satisfaction

If those metrics move meaningfully, scaling becomes the obvious next step.

5.2 The 30-Day Preparation Phase

Before running even one live payment, align the organisation around the pilot. The goal is a clean internal foundation with no surprises during testing.

Select the Use Case

Choose a Tier 1 scenario that is already proven:

- Cross-border supplier payouts

- Host payouts

- Treasury optimisation

Avoid complex multi-party flows at first.

Choose 1–2 Markets

Start where the economics are undeniable:

- High FX costs

- Frequent payout delays

- Difficult banking infrastructure

- High support burden

Emerging markets often provide the clearest results.

Select a Licensed Payments Provider

Use only regulated, enterprise-grade partners (e.g., Stripe, Coinbase, Worldpay-BVNK, Circle partners). They handle:

- KYC/KYB

- On/off-ramping

- Compliance

- Reporting

- Fiat payouts

- Technical reliability

The pilot should not require wallets or blockchain expertise.

Align Compliance Early

Compliance teams generally ask about:

- AML monitoring

- Transaction provenance

- Fiat conversion

- Partner licensing

- Jurisdictional rules

- Data retention

Involving them early removes the main internal friction point.

Notify Accounting & Tax

This is essential. Accounting must prepare:

- Ledger mapping

- FX classification

- Payout documentation

- Reporting workflows

Stablecoin pilots become messy only when accounting is looped in too late.

Map Existing Payout Workflows

Understand where stablecoin settlement slots into:

- OTA → PMS → Host payouts

- Travel agency → supplier payments

- Consolidator flows

- Treasury funding cycles

The pilot should not modify upstream systems — only the payout rail.

Prepare a Fallback Plan

Executives appreciate safety rails:

- "If stablecoin rail fails, switch back to bank transfer instantly."

- "If the processor has downtime, freeze payouts for 30 minutes."

This preserves confidence and minimises perceived risk.

Communicate to Pilot Participants

Suppliers/hosts should hear:

- "You will receive payouts faster."

- "You will still receive fiat."

- "No crypto knowledge is required."

- "This is optional and non-disruptive."

Clear communication eliminates fear.

5.3 Months 2–3: Integration and Internal Testing

This phase proves technical readiness before involving external partners.

Technical Integration

Set up:

- API connection to the stablecoin processor

- Authentication keys and sandbox environment

- Automated payout triggers

- FX handling rules

This is usually significantly faster than traditional payment integration.

Reconciliation Mapping

Define how each transaction appears in:

- Internal ledgers

- PMS systems

- ERP/accounting tools

- Bank statements

- Cash-flow models

Stablecoins improve reconciliation, but reporting must be aligned first.

FX & Treasury Handling

Decide:

- Whether FX is handled by the processor

- When funds convert back to fiat

- Treasury yield allocation rules

- Risk tolerance and exposure limits

Keep all rules simple for the pilot.

Staff Training

Operational teams should understand:

- How payouts are triggered

- How to trace a stablecoin transaction

- When to escalate

- How to verify settlement times

- What fallback procedures apply

The goal is operational calm.

Simulate Weekends & Holidays

One of the biggest advantages of stablecoin rails is 24/7 settlement. Simulating weekend payouts validates:

- Faster cash flow

- Fewer support tickets

- Better partner satisfaction

The difference becomes immediately visible.

5.4 Months 3–4: Live Pilot With Real Payments

This is the real test — but still small and controlled.

Choose a Subset of Partners

Ideal pilot groups:

- 10–50 hosts in high-friction markets

- A single large supplier

- A regional set of DMCs

- One consolidator payment channel

They must feel the pain enough to appreciate the improvement.

Run Real Transactions

Test under realistic conditions:

- Weekends

- Cross-time-zone payouts

- FX conversion

- Refund scenarios

- Volume bursts

The pilot should stress-test the rail.

Monitor KPIs Actively

Evaluate:

- Average settlement time

- Cost per transaction

- FX transparency

- Error/failure rate

- Reconciliation adjustments

- Support ticket volume

- Partner feedback

If the pilot works, these metrics will improve quickly and measurably.

Maintain an Opt-Out Path

Partners should know:

- They can opt out any time

- They still receive fiat

- Nothing changes on their end

Minimise friction to maximise participation.

5.5 Months 4–6: Review and Expand

After 8–12 weeks:

Compare KPIs Against Baseline

Most companies will see improvements in:

- Cost

- Settlement time

- Reliability

- Support load

- Reconciliation clarity

Validate Economics

This includes:

- Net savings

- Treasury yield

- Reduced error handling

- Lower dispute resolution costs

The business case becomes explicit.

Refine Workflows

Document:

- What worked

- What failed

- What needs automation

- What needs more guardrails

This becomes the institutional playbook.

Choose Expansion Markets

Select regions with:

- High banking friction

- Strong supplier interest

- Clear cost advantages

Formalise Internal Policy

Define:

- FX handling

- Treasury limits

- Accounting entries

- Reconciliation practices

- Compliance protocols

Codify the pilot into a repeatable process.

5.6 Risks and Mitigations

A clear, honest table executives appreciate:

| Risk | Description | Mitigation |

|---|---|---|

| Regulatory shifts | New guidelines may change requirements | Use licensed providers; payout fiat by default |

| Bank friction | Banks may question inflows/outflows | Work with compliant processors; maintain documentation |

| Accounting complexity | New ledger categories | Prepare mapping early; pre-align with accountants |

| FX confusion | Teams mishandle conversions | Let processor handle FX entirely |

| Technical downtime | On/off-ramp outages | Keep legacy payout rails as instant fallback |

| Partner perception | Fear of "crypto" | Default to fiat payouts; stablecoins hidden underneath |

This is the confidence layer that removes internal resistance.

5.7 Monday Morning Checklist

A one-page quick-start for executives. If someone wants to begin next week, they need only follow this list:

- Select one Tier 1 use case

- Pick 1–2 markets

- Choose a licensed payments partner

- Brief compliance and accounting

- Map existing payout logic

- Prepare communication for pilot participants

- Define KPIs and measurement intervals

- Activate sandbox integration

- Schedule internal test transactions

- Confirm fallback path

- Assign a project owner

- Set pilot start date

Keep it clear, simple and actionable.

5.8 The Minimum Viable Pilot

If your company wants the safest, most conservative form of experimentation, use this template:

- One supplier or 20–30 hosts

- One country with high banking friction

- Processor handles FX and conversion

- All recipients receive fiat payouts

- No wallets required

- No guest-facing changes

- 30–45 day duration

- Stablecoin never touches company balance sheet

- Legacy rails remain active at all times

This setup produces real data with near-zero organisational risk.

Conclusion

A stablecoin pilot is not a leap into the unknown. It is a tightly controlled experiment that sits alongside your existing payment infrastructure. The objective is proof, not transformation. Companies that follow this structured approach discover quickly whether the economics, speed, and reliability gains justify broader adoption.

With implementation mapped, the next chapter examines which providers deliver these capabilities and how to choose the right partner for your specific use case.

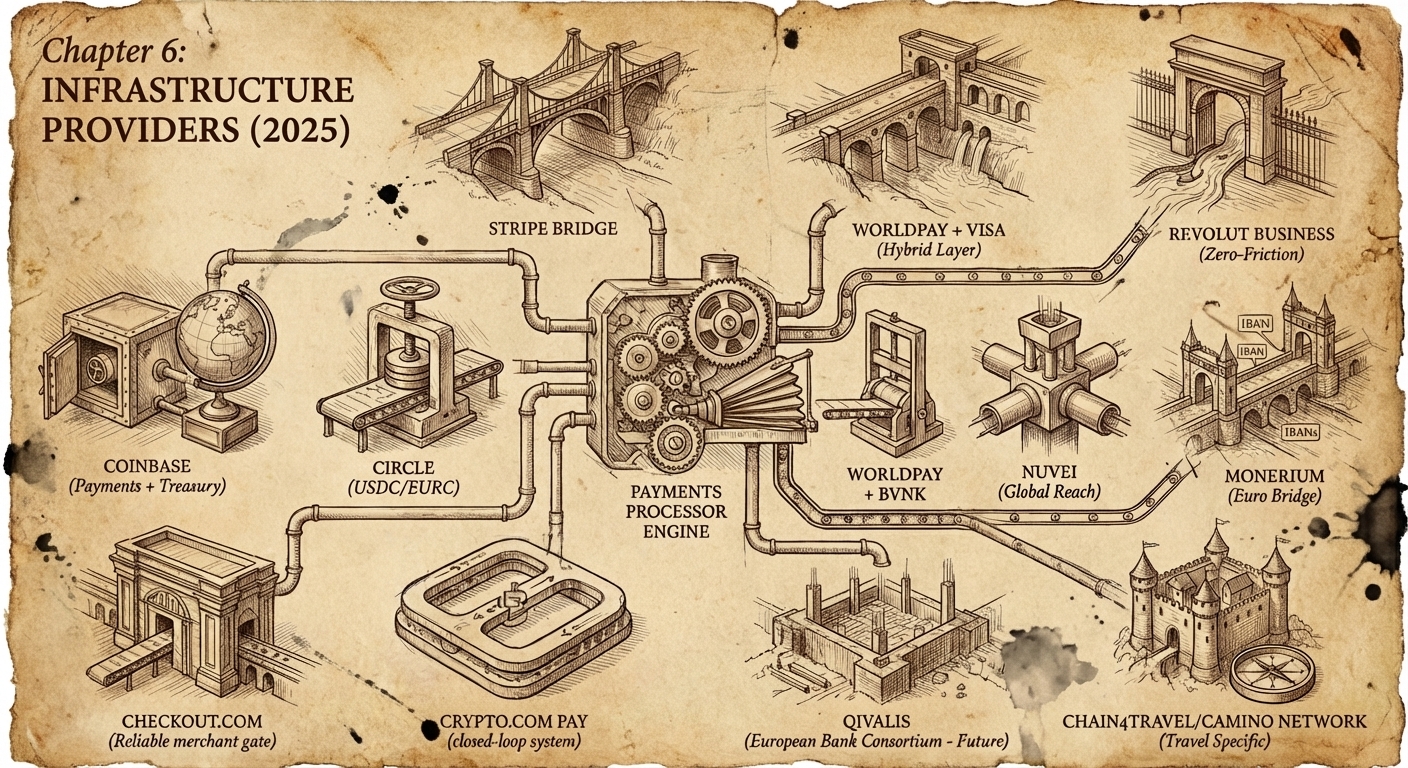

Chapter 6: INFRASTRUCTURE PROVIDERS

Stablecoin payments do not require a blockchain integration, a wallet infrastructure, or crypto expertise. They require one thing: a licensed payments provider that abstracts everything behind a familiar API. The processor handles the blockchain, conversions, custody, compliance, and reconciliation. Your company integrates a payout rail — not a technology stack.

This chapter explains the role of the processor, compares the major providers in 2025, and gives you a practical framework for choosing the right one based on your use case.

6.1 The Role of the Payments Processor

Stablecoins sit under the processor, not inside your systems. A mature provider handles:

- Custody and wallet management

- On/off-ramping (from stablecoins to fiat and viceversa)

- FX execution and conversion

- Stablecoin minting/burning

- Compliance (KYC/KYB, AML, reporting)

- Settlement risk

- Ledger generation

- Error-handling and retries

- Chargeback prevention (for B2B)

- Transaction traceability

From your perspective, this is simply a new payout rail.

The processor absorbs 95% of the complexity. Because of this, choosing the right provider is the most important decision in the entire implementation roadmap.

6.2 The Major Providers in 2025

2024–2025 produced a rare moment of parallel evolution. The major global payments companies all launched stablecoin rails within months of each other.

Stripe (Bridge)

- Strengths: UX, enterprise reliability, excellent documentation, unified payment stack

- Weaknesses: Limited crypto-native flexibility

- Best for: OTAs, PMS companies, mainstream travel brands

Coinbase (Payments + Business)

- Strengths: Deep liquidity, global coverage, strong treasury tools, enterprise custody

- Weaknesses: Slightly more crypto-native complexity

- Best for: Supplier payouts, treasury optimisation, global markets Coinbase is the standard for institutional custody, managing over $193 billion in digital assets. As the custodian for the majority of spot Bitcoin ETFs, they offer the deepest liquidity and most robust treasury tooling for large enterprises.

Circle (USDC/EURC APIs)

- Strengths: Issuer-level visibility, regulatory clarity, multi-currency stablecoins

- Weaknesses: Less "plug-and-play" than Stripe

- Best for: Platforms that want to build stablecoin-native treasury and settlement systems

Worldpay + BVNK

- Strengths: Travel-focused payout infrastructure, FX control, multi-rail settlement

- Weaknesses: Newer offering

- Best for: OTAs, PMS companies, airlines, high-volume suppliers

Worldpay + Visa (The Hybrid Layer)

- Strengths: The ultimate bridge. Visa now settles USDC on Solana directly with acquirers like Worldpay and Nuvei.

- Best for: Merchants who want the backend speed of stablecoin settlement without changing their existing acquirer relationships. This allows the settlement layer to run on blockchain even if the customer pays with a standard Visa card.

Revolut Business

- Strengths: The "Zero-Friction" standard. As of November 2025, Revolut enables guaranteed 1:1 conversion between USD, USDC, and USDT with zero fees across six blockchains.

- Best for: SMB travel agencies and independent contractors. By treating stablecoins as cash equivalents (eliminating the spread between $1.00 fiat and 1.00 USDC), they have solved the "ledger dust" problem, making accounting for crypto payouts identical to handling standard currencies.

Checkout.com (quiet but active)

- Strengths: Early mover (since 2022), strong global merchant base

- Weaknesses: Limited stablecoin payout documentation

- Best for: Large merchants already on Checkout rails

Monerium (The Euro Bridge)

- Strengths: The only provider offering "on-chain IBANs." When you send Euros via SEPA Instant, Monerium automatically mints authorized EURe tokens to the recipient's wallet. Redemption is just as fast: send EURe to an IBAN, and it lands as fiat Euros.

- Weaknesses: Euro-centric focus; less liquidity than global USD pairs.

- Best for: European travel companies. It proves you do not need to convert to USD to benefit from blockchain settlement. You can stay entirely in Euros, retain your existing banking relationships, and operate with full MiCA compliance.

The Banking Response: Qivalis (Coming H2 2026)

The Player: In December 2025, a consortium of 10 major European banks (including BNP Paribas, ING, UniCredit, and CaixaBank) announced Qivalis.

The Promise: A fully regulated, bank-backed Euro stablecoin designed to challenge USD dominance.

Why it Matters: While not live for immediate pilots, this is the ultimate "safe harbor" signal. It proves that stablecoin rails are not a temporary trend—they are the future architecture of European banking. Conservative treasurers can move to stablecoins today knowing their primary banks are building the exact same rails for tomorrow.

Nuvei

- Strengths: Massive travel footprint (Virgin Atlantic, Air Transat, Radisson) and global reach (200+ markets). They offer modular stablecoin settlement alongside 700+ other payment methods.

- Best for: Global airlines and travel merchants who need local acquiring in 50+ countries alongside crypto settlement options.

Crypto.com Pay

- Strengths: Zero transaction fees within their ecosystem and instant settlement.

- Weaknesses: Closed-loop incentives; best used as a marketing/loyalty play rather than pure B2B infrastructure.

- Best for: OTAs seeking to acquire crypto-native travelers (e.g., the Emirates partnership model) by tapping into Crypto.com's massive retail user base.

6.3 Specialized Travel Infrastructure: Chain4Travel (Camino Network)

While providers like Stripe and Coinbase act as gateways to general-purpose blockchains, Chain4Travel has taken a different approach: building a Layer 1 blockchain specifically for the travel industry.

The Consortium Model (Trust & Compliance)

Unlike public networks where anyone can validate transactions, Camino operates as a permissioned consortium. It uses "Proof-of-Stake Authority" (PoSA), meaning the network is secured and governed by verified industry participants—including Lufthansa Group, TUI, Eurowings, and DERTOUR. For travel executives, this removes the compliance headache of "anonymous" blockchains; every validator is a known, KYC/KYB-verified travel entity.

The Killer App: Camino Messenger

The core innovation isn't just the token; it's the Camino Messenger. This B2B wallet-to-wallet communication standard unifies distribution and settlement.

- Speed: Connectivity between partners can be established in roughly 20 minutes (compared to months for traditional API integrations).

- Unified Flow: A booking request (distribution) and its payment (settlement) happen in the same encrypted message flow.

- AI Readiness: The Messenger infrastructure is designed to allow AI agents to negotiate bookings and execute payments autonomously, positioning it as the backbone for the next wave of travel tech.

Payment & Settlement Capabilities

- Stablecoin Integration: Through a partnership with Monerium, the network supports authorized EURe (digital Euro) payments. This enables programmable transfers between web3 wallets and traditional IBANs with near-instant settlement.

- B2B Efficiency: Implementations like PayDocker (integrated with Camino) report cost reductions of up to 70% by replacing expensive Virtual Credit Cards (VCCs) with smart contract settlements.

- Solving the Non-BSP Problem: Lufthansa Group and FinMont use the network to streamline B2B payments in markets where traditional IATA settlement infrastructure is lacking or too slow.

Why It Matters:

Chain4Travel isn't just a payment rail; it's a shared operating system. It allows for "smart" transactions—like splitting a commission automatically between an OTA, a hotel, and an activity provider in a single, irreversible atomic transaction.

Best For:

Consortia, large tour operators, and B2B marketplaces looking to own their infrastructure and automate complex multi-party settlements.

6.4 Capabilities Comparison Table

(Details reflect 2025 offerings; coverage expands quickly.)

| PROVIDER | LICENSING | CURRENCIES | CUSTODY | FX | PAYOUT COVERAGE | BEST FOR |

|---|---|---|---|---|---|---|

| Stripe | Global | USD/EUR | Custodial | Processor managed | Strong in EU/US | OTAs, PMS |

| Coinbase | US, EU, APAC | USD | Enterprise custody | Deep liquidity | Global | Supplier payouts, treasury |

| Circle | US/EU | USDC, EURC | No custody (issuer) | Tight spread | Global | Platforms building directly |

| Worldpay BVNK | Global | USD/EUR/GBP | Custodial | Excellent for FX | EM regions | Travel specialists |

| Checkout.com | Global | USD/EUR | Custodial | Standard | Global | Existing Checkout merchants |

6.5 Which Provider Fits Which Use Case

Supplier Payouts

Best: Coinbase, Worldpay-BVNK, Stripe Why: Strong FX, broad reach, fast settlement.

Host Payouts

Best: Stripe, Worldpay-BVNK Why: Smooth onboarding, fiat payouts, excellent reconciliation.

Treasury Optimisation

Best: Coinbase Business, Circle APIs Why: Highest liquidity, clear yield products, enterprise custody.

Commission Automation

Best: Circle, Coinbase, Worldpay-BVNK Why: Metadata support, on-chain clarity, programmable flows.

PMS Native Integration

Best: Stripe, Worldpay-BVNK Why: Strong partner support, easy rollout, multi-market payout modules.

6.6 Cost Structures & Hidden Variables

Stablecoin transactions appear simple — but cost structures vary widely.

FX Margin

The biggest cost variable. Some providers add 0.5%, some add 1.2%, some pass through spot.

Blockchain Fees

Usually negligible (Solana/Base), but must be confirmed.

Custody Fees

Enterprise custody sometimes has additional cost tiers.

Payout Geography

Costs differ by region based on liquidity and compliance.

Withdrawal Fees

Some processors charge per fiat withdrawal; others bundle it.

"Enterprise Features" Premium

High-SLA contracts often include:

- Dedicated support

- Custom routing

- Bulk payments

- Reconciliation assistance

- Custom reporting

The guide helps you anticipate this.

6.7 What "Production-Grade" Actually Means

This is where mature processors differentiate.

Uptime

Look for 99.95% uptime minimum.

Documentation Quality

Mature APIs include: examples, error codes, testing flows, and audit logs.

Sandbox Environment

The best providers let you simulate everything, including FX and failure cases.

Compliance Handling

KYC/KYB, AML, sanctions screening, country restrictions — all automated.

Error Handling & Retry Logic

Essential for payouts in emerging markets.

Reconciliation Support

You want downloadable logs, metadata, and automated mapping.

Operational Tooling

Dashboards, reporting, alerts, payout tracing.

The gap between providers is wide. This checklist separates hobby-grade "crypto processors" from real enterprise rails.

6.8 Choosing the Right Provider: A Simple Framework

1. What use case are you solving?

Supplier payouts, host payouts, loyalty, treasury.

2. In which markets?

EU/US → Stripe Global → Coinbase Emerging markets → Worldpay-BVNK

3. What is your internal capacity?

Low engineering → Stripe / Worldpay-BVNK High engineering → Circle / Coinbase

4. What do you want to optimise?

Cost, speed, treasury yield, FX, reliability.

The decision becomes obvious once these questions are answered.

Conclusion

Choosing the right payment provider determines the success of your stablecoin pilot more than any other factor. The provider handles the blockchain complexities, regulatory requirements, and operational risk so your teams can focus on delivery, not technology.

With the provider landscape understood, we now turn to the adoption landscape: Who is already moving, who is waiting, and what this means for your timing.

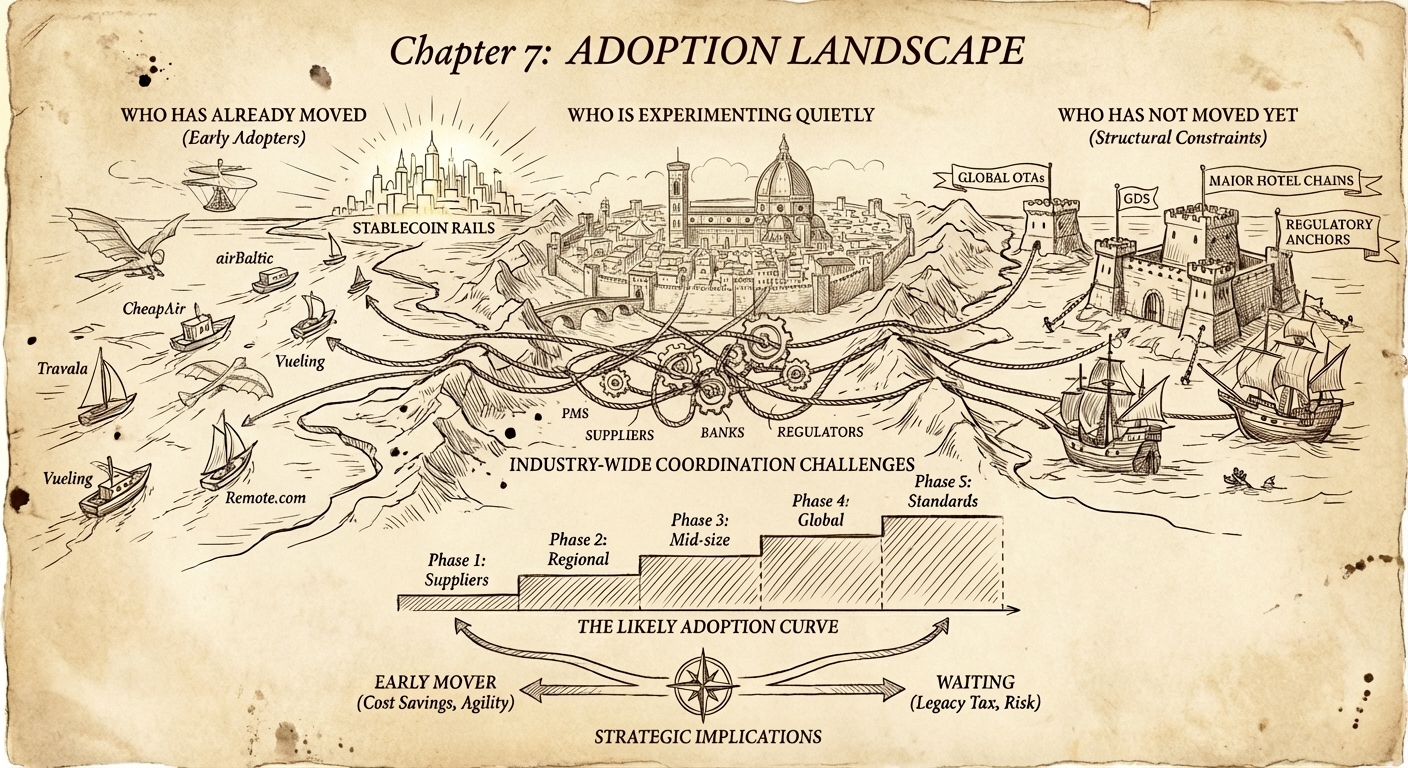

Chapter 7: ADOPTION LANDSCAPE

Stablecoin rails are ready, the infrastructure exists, the economics are compelling — but adoption across the travel industry remains uneven. Some companies have already moved aggressively, others are testing quietly, and many are waiting for clearer signals before committing resources.

This chapter maps the landscape so you can benchmark your own strategy, understand where the momentum is coming from, and identify the areas where hesitation is still normal.

7.1: Who Has Already Moved

Travel is not the first industry to adopt stablecoin rails — but the early adopters are already proving the value.

airBaltic

One of the earliest adopters of crypto-based payments. While known for accepting digital assets for tickets (inbound), their longevity proves that airline treasury systems can successfully integrate with blockchain ledgers for settlement and reconciliation.

Travala

A crypto-native travel booking platform that uses stablecoins extensively for both payments and payouts. While not representative of mass-market adoption, Travala demonstrates that global travel settlement can operate reliably on stablecoin rails.

CheapAir

A pioneer in the space, CheapAir has accepted digital assets for over a decade. Unlike newer entrants chasing hype, they view crypto payments as a reliability play. By 2025, they have eliminated conversion fees on these bookings and leveraged the rails to attract a high-value, tech-forward demographic that prefers self-custody over credit cards.

Vueling

The IAG-owned low-cost carrier became the first European airline to integrate widespread crypto acceptance in 2023. Using a "push" payment model via UATP and BitPay, Vueling eliminated chargeback risk on these tickets entirely—a significant margin unlock in the low-cost carrier model where fraud prevention costs are high.

Dtravel

While smaller than Airbnb, Dtravel represents the "pure" version of the stablecoin thesis. It operates as a decentralized direct-booking layer where the fee structure is negligible compared to traditional OTAs. For property managers, it serves as a live production environment to test wallet-based payouts and smart-contract booking logic without risking their core revenue streams.

Emirates (announced initiatives)

Emirates has publicly discussed blockchain-based settlement experimentation. While details remain limited, it signals interest among large, conservative carriers.

Remote.com

A global payroll company using USDC to pay workers and contractors in markets where traditional banking is unreliable. Travel companies see this as a blueprint for paying suppliers and tour operators in emerging markets.

Starlink

Uses stablecoins for global remittances across difficult banking environments — a strong example for travel companies dealing with suppliers in Africa, South America, and Southeast Asia.

LATAM and APAC travel suppliers

In practice, a quietly growing number of inbound operators, guides, and activity providers already request USDT or USDC for operational reasons:

- Faster cash flow

- Easier FX

- Local banking issues

This long-tail has not appeared in formal reports, but travel buyers notice it directly.

These examples show that stablecoin rails are not speculative: they work today in some of the harshest banking environments.

7.2 Who Is Experimenting Quietly

Most stablecoin experimentation in travel is happening out of public view. Companies exploring these rails generally do so under NDA or within small internal teams. Because no major pilot involving traditional travel brands has been formally announced, it is not possible to attribute stablecoin payout tests to specific airlines, consolidators, or booking platforms.

What we can say publicly is the following:

-

Stablecoin processors (Stripe/Bridge, Coinbase, Circle, Worldpay-BVNK) have confirmed they are onboarding enterprise clients across multiple industries, including travel, but none have disclosed the names of those travel partners.

-

Inbound operators and suppliers in emerging markets are known to request USDT/USDC from agencies informally due to banking challenges, but this behaviour is not tied to specific corporate pilots.

-

Private discussions between travel companies and payment providers are occurring, but no company has officially confirmed a stablecoin-based payout or settlement pilot.

In short: There is clear interest, but no verifiable public pilot announcements from traditional travel brands beyond the known cases (airBaltic, Travala, Emirates discussions).

7.3 Who Has Not Moved Yet — and Why

Large OTAs, global distribution systems, and major hotel chains have not yet fully adopted stablecoin rails. Not because the technology lacks readiness, but because these companies face structural constraints.

OTAs

Barriers include:

- Global regulatory exposure

- Brand sensitivity

- Complex refund workflows

- Multi-market payout logic

- High compliance overhead

OTAs tend to adopt payment innovations only after ecosystem maturity.

GDS and legacy intermediaries

These systems operate under strict financial regulations and legacy architecture built decades ago. Shifting to a new settlement rail requires multi-year roadmaps.

Major hotel chains

Centralized payment models, franchise structures, and global liability concerns make them cautious. They will follow, but they will not lead.

Large travel insurance companies

They require regulatory approval for parametric and automated settlement models before adopting blockchain-based rails.

In short: the companies with the largest global exposure move slowest.

7.4 Industry-Wide Coordination Challenges

Adoption remains uneven not because of technical barriers, but because stablecoin rails require coordination across multiple actors:

- OTAs

- PMS platforms

- Suppliers

- Banks

- Acquirers

- Processors

- Regulators

- Accounting systems

Travel's multi-layered ecosystem creates friction:

- No standard for on-chain booking metadata